The National Bank of Ethiopia (“NBE”) issued a new directive (Directive No. FXD/79/2021) governing the retention and utilization of foreign currency earnings from export and inward remittance. Previously the area was regulated by the Directive No. FXD/73/2021 (“Old Directive”). In this edition of our legal update, we have tried to look in to the changes introduced by the New Directive preceded by a highlight on the changes made by the series of directives of NBE governing the area.

The National Bank of Ethiopia (“NBE”) issued a new directive (Directive No. FXD/79/2021) governing the retention and utilization of foreign currency earnings from export and inward remittance. Previously the area was regulated by the Directive No. FXD/73/2021 (“Old Directive”). In this edition of our legal update, we have tried to look in to the changes introduced by the New Directive preceded by a highlight on the changes made by the series of directives of NBE governing the area.

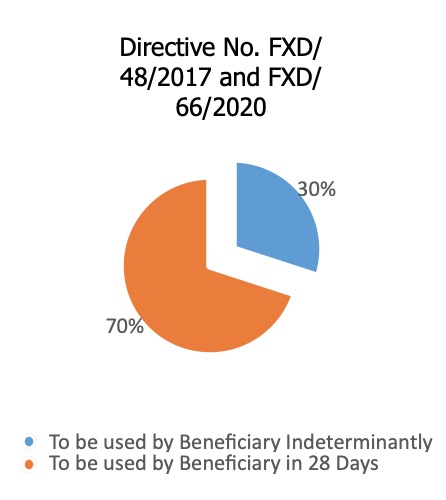

For three years, this part of the foreign currency management regimes of NBE was regulated by the Retention and Utilization of Export Earnings and Inward Remittance Directive No. FXD/48/2017 that entered in to force on 3 October 2017 and was effective until replaced by the Retention and Utilization of Export Earnings and Inward Remittance Directive No. FXD/66/2020 that entered in to force as of the 16 September 2020. The later Directive introduced minor changes regarding credit of funds in retention accounts for local merchants or entities licensed by NBE and the manner of using foreign currency available in Retention account A and B. Under both these directives, an exporter or a foreign currency remittance beneficiary had the right to maintain 30% of the foreign currency earnings in Retention Account A for indefinite period of time and the remaining 70% would be retained in Retention Account B for a period of 28 days and before the lapse of the 28 days it was possible to use the currency for importing specified items.

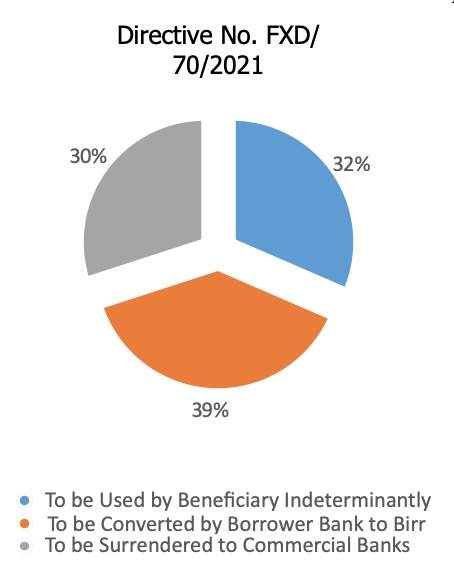

NBE issued Directive No. FXD/70/2021 by repealing Directive No. FXD/66/2020. Directive No. FXD/70/2021 entered in to force as of 09 March 2021. This Directive brought about significant changes by, among others, eliminating the Retention Account “A” and Retention Account “B” and recognizing only one Forex Retention Account, establishing a mandatory surrender requirement where all the beneficiaries are required to surrender 30% of the foreign currency earning to NBE, and reduced the amount of proceeds to be retained in the retention account to 45% (of the remaining currency after the surrender) and it required the sale of 55% (of the remaining currency after the surrender) of the foreign currency earning to the banks immediately on the day of receipt at the prevailing buying exchange rate. It also changed the requirements for utilization of the foreign currency permitting beneficiaries to use the foreign exchange for the importation of goods and services without restriction as long as it has a business license to import these goods and services.

NBE issued Directive No. FXD/70/2021 by repealing Directive No. FXD/66/2020. Directive No. FXD/70/2021 entered in to force as of 09 March 2021. This Directive brought about significant changes by, among others, eliminating the Retention Account “A” and Retention Account “B” and recognizing only one Forex Retention Account, establishing a mandatory surrender requirement where all the beneficiaries are required to surrender 30% of the foreign currency earning to NBE, and reduced the amount of proceeds to be retained in the retention account to 45% (of the remaining currency after the surrender) and it required the sale of 55% (of the remaining currency after the surrender) of the foreign currency earning to the banks immediately on the day of receipt at the prevailing buying exchange rate. It also changed the requirements for utilization of the foreign currency permitting beneficiaries to use the foreign exchange for the importation of goods and services without restriction as long as it has a business license to import these goods and services.

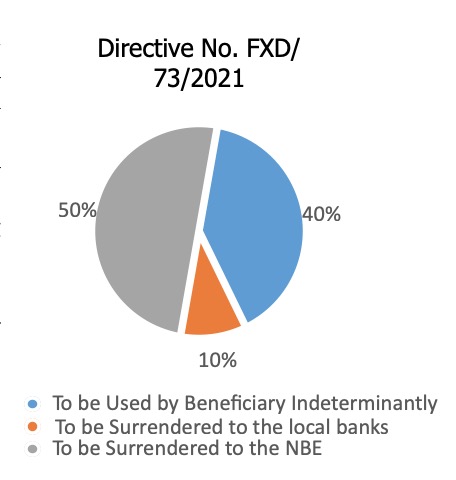

Effective from 01 September 2021, NBE repealed Directive No. FXD/70/2021 and issued Directive No. FXD/73/2021 governing the retention and utilization of foreign currency earnings from export and inward remittance. This Directive introduced 50% - 40% - 10% allocation requiring exporters and remittance earners to surrender 50% of their total earnings to NBE, permitted the account holders to retain 40% of the foreign currency earning indefinitely and sale the remaining 10% to the commercial banks.

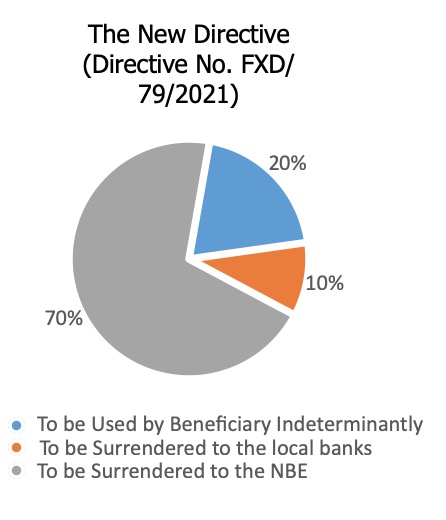

Directive No. FXD/73/2021 is a short lived one as NBE replaced it by a New Directive (Directive No. FXD/79/2021(“New Directive”)) that takes effect from 06 January 2022. The basic changes introduced by this New Directive are:

Total surrender amount is increased: Under the New Directive, exporters and inward remittance earners are required to surrender 70% of their total earnings to NBE. Previously, exporters and inward remittance earners were required to surrender 50% of their total earnings to NBE.

Total surrender amount is increased: Under the New Directive, exporters and inward remittance earners are required to surrender 70% of their total earnings to NBE. Previously, exporters and inward remittance earners were required to surrender 50% of their total earnings to NBE.

Amount of proceeds to be retained is significantly decreased: Under the Old Directive, retaining 40% of the total foreign currency earning for indeterminate period of time in a retention account was permitted after deduction of the 50% surrender requirement. The remaining 10% of foreign currency amount was required to be surrendered to the respective commercial banks based on the prevailing exchange rate and using the buying rate. Under the New Directive, the amount of foreign currency to be surrendered has increased significantly. Commercial banks are required to surrender 70% of the total foreign currency earning from export and remittance earnings to the NBE. The remaining 10% of the foreign currency amount is required to be surrendered to the respective commercial banks based on the prevailing exchange rate and using the buying rate.

Simply put, the New Directive changed the allocation to 70% - 20% - 10% (70 percent to NBE, 20 percent to the retention account for the benefit of exporters and inward remittance earners and 10 percent to commercial banks).

Simply put, the New Directive changed the allocation to 70% - 20% - 10% (70 percent to NBE, 20 percent to the retention account for the benefit of exporters and inward remittance earners and 10 percent to commercial banks).

Disclaimer: This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. Mehrteab Leul & Associates is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website.

Copyright©2022 Mehrteab Leul & Associates. All rights reserved.